Effective Tax Bracket Calculator 2025. For this year, the financial year will be. In 2025 and 2025, there are seven federal income tax rates and brackets:

New york state tax $3,413. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

2025 Tax Rates & Federal Tax Brackets Top Dollar, In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). If you're expecting a refund, consider how.

Seguro médico en California. 31.368 dólares al año. 2614 dólares al mes, As your income goes up, the tax rate on the next layer of income is higher. If you need to access the calculator for the 2025 tax year and the.

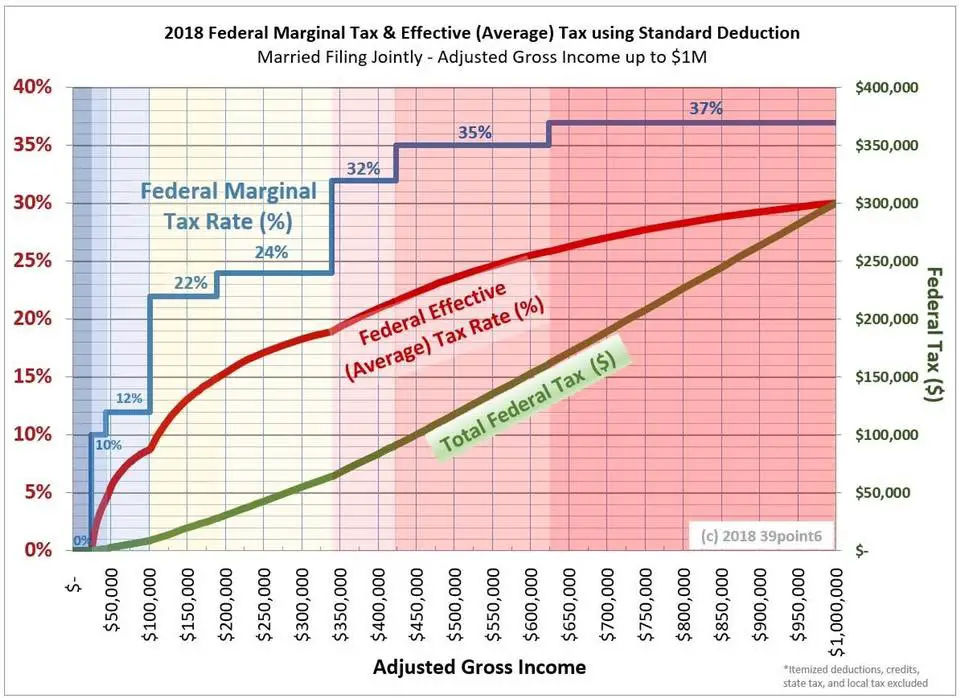

Your 2013 Tax Rate Understanding Your IRS Marginal and Effective Tax, With our tax bracket calculator, you can easily check which tax bracket you are in and find the federal income tax on your income.besides, for better insight, you can. When your income jumps to a higher tax bracket, you don't pay the higher rate on your.

Federal Tax Deposit Requirements 2025 Election Nelia, To determine your marginal tax rate, the tool recalculates your total federal income tax. New york state tax $3,413.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, If you're expecting a refund, consider how. If you need to access the calculator for the 2025 tax year and the.

2025 Federal Marginal Tax Rates Printable Forms Free Online, Then 12% on the next $33,725, then 22% on the final $5,275 falling in the third bracket. The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all.

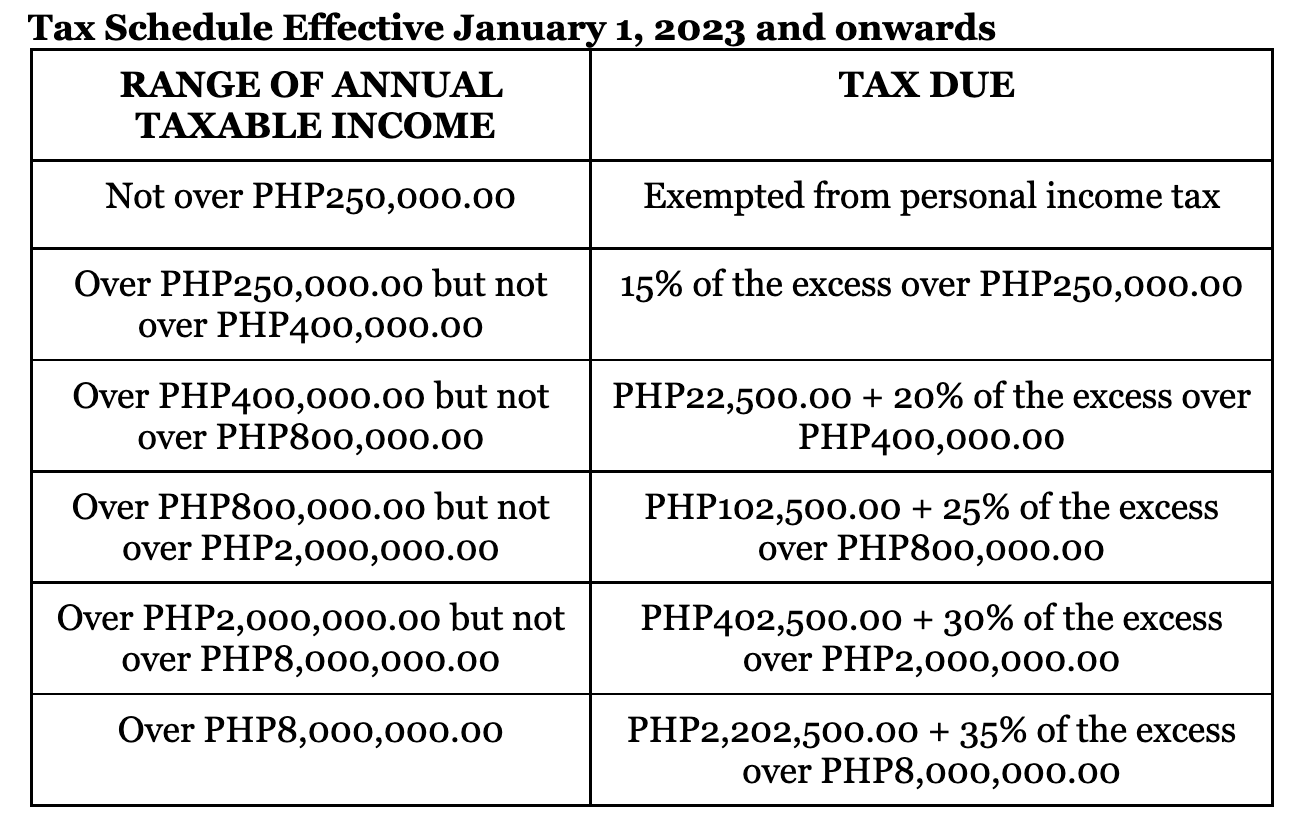

BIR Tax Schedule Effective January 1 2025, This tool is designed to assist with calculations for the 2025 tax return and forecasting for the 2025 tax year. Below are the tax brackets for 2025, detailing the rates from 10% to 37% across different income ranges and filing categories:

Tax bracket calculator 20212022 What are the federal taxes and, Calculate your combined federal and provincial tax bill in each province and territory. The 2025 tax year—meaning the return you’ll file in 2025—will have the same seven federal income tax brackets as the last few seasons:

How To Calculate Your Marginal Tax Rate Haiper, Here is a list of our partners and here's how we make money. In india, income tax is calculated using income tax slabs and rates for the applicable financial year (fy) and assessment year (ay).

Tax Prep Documents Checklist from H&R Block, If you're expecting a refund, consider how. When your income jumps to a higher tax bracket, you don't pay the higher rate on your.